YOU ARE

A BRITISH CITIZEN

Access to healthcare

In accordance with the withdrawal agreement, as of the 1 February 2020, British citizens without dual nationality are no longer eligible to vote or stand in local and European elections held in France.

The withdrawal agreement provides specific provisions for British nationals settled in France before December 31, 2020. In most cases, you retain your rights acquired before this date and continue to benefit from social security coordination mechanisms.

If you wish to settle in France, you are not covered by these provisions but the trade and partnership agreement provides for the coordination of social security in certain areas.

You are concerned if you are a British citizen residing in France and you are affiliated with British health insurance.

Didn't find the answers to your questions on this page? You can contact us at the following address: brexit@sante.gouv.fr.

FREQUENTLY ASKED QUESTIONS

-

Under the provisions of the withdrawal agreement and if your situation remains the same, your health insurance coverage and the conditions under which you are insured will not change. You will continue to receive benefits under the same conditions as you do now.

EU rules on coordination of social security systems will continue to apply after 31 December 2020, which signals the end of the transition period, meaning that your rights will be maintained. These rules provide that – if you are receiving a pension from one State and reside in the territory of another State – your health insurance will be covered by the State that pays your pension. This means that your healthcare costs in France will continue to be covered by the French social security system on behalf of the United Kingdom.

If you have not already done so, you must request an S1 form “Registering for healthcare cover” from your British pension fund. This document will allow you to register with the French health insurance fund in your place of residence. The form will be valid for your entire period of residency in France and will provide you with coverage under the same conditions as a person insured under the French social security system.

If you also start to receive a French pension, and you continue to live in France, the coordination rules provide that the French system will directly cover your health insurance.

The provisions of the EU-UK Trade and Cooperation Agreement, which apply from 1 January 2021, are similar to existing provisions in EU regulations on coordination of healthcare. This will apply to situations as from 1 January 2021.

-

Based on the provisions of the withdrawal agreement that recognize the preservation of rights accrued prior to 31 December 2020, if your situation does not change, your health coverage and the conditions under which you are insured will not change. You will continue to receive benefits under the same conditions as you do now by completing S1 form "Registering for healthcare cover", which you can request from your British social security fund. This document will allow you to register with the health insurance fund in your place of residence in France. Form S1 will remain valid for as long as you reside in France and will allow you to receive care under the same conditions as if you were insured under the French social security system.

-

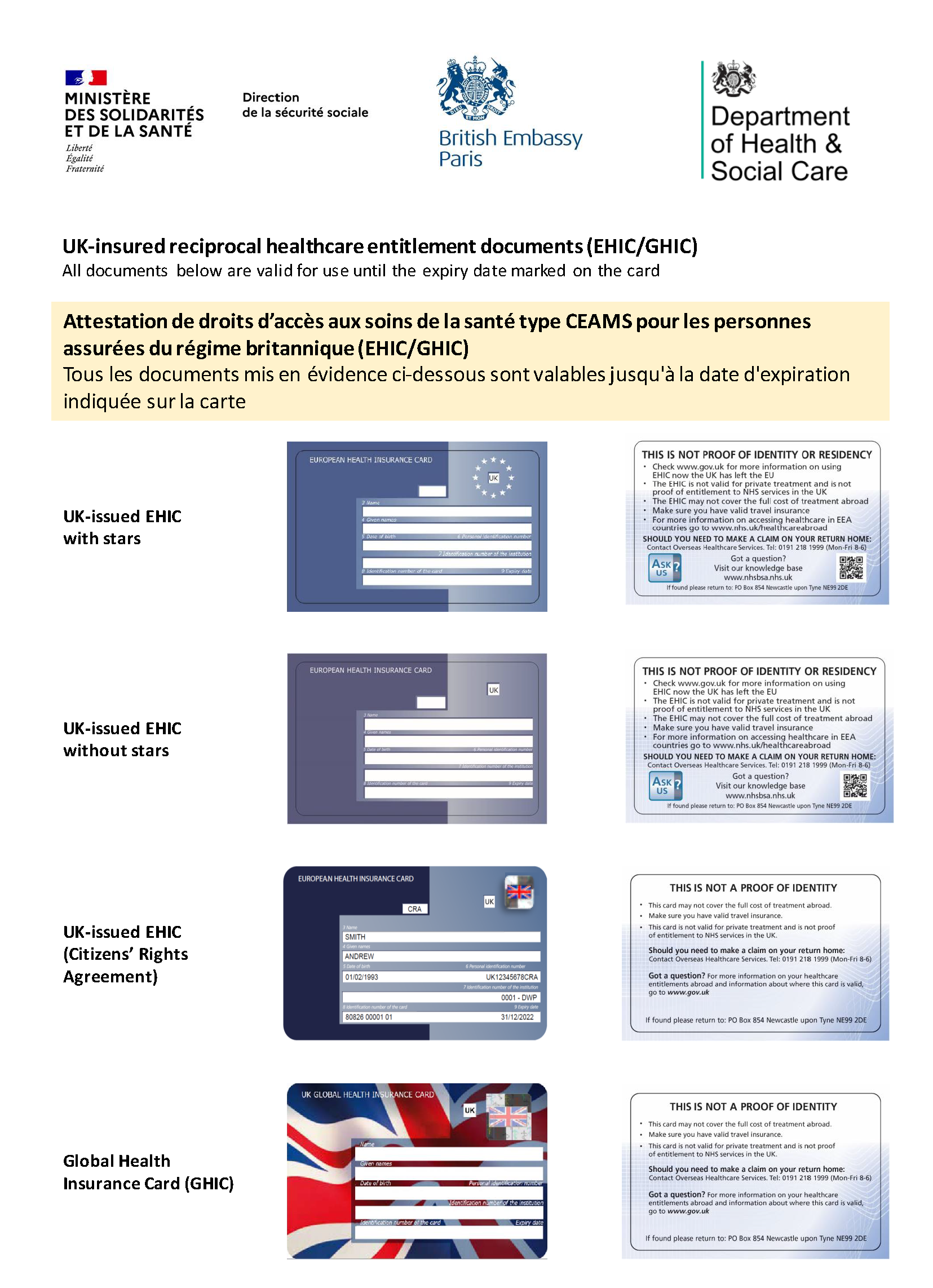

If you continue to work and live in France after 31 December 2020, you will be able to use your EHIC during temporary stays in the UK subsequent to this date. Make sure you download the Provisional Replacement Certificate (PRC) from your personal account beforehand. This document, which is issued for a shorter period, certifies that you are covered by the withdrawal agreement and you will be asked for it in addition to, or instead of, your EHIC.